Top 3 Financial Statement Review Tools for Audit Teams in 2025

Jul 4, 2025

As audit teams face increasing pressure to work faster and with greater precision, the financial statement review process has become a key area for innovation. The traditional method — printing PDFs, adding tick marks by hand, and manually reconciling figures — is no longer sufficient in a digital-first audit environment.

🥇 1. Nexly – Financial Statement Review Tool for Audit Teams

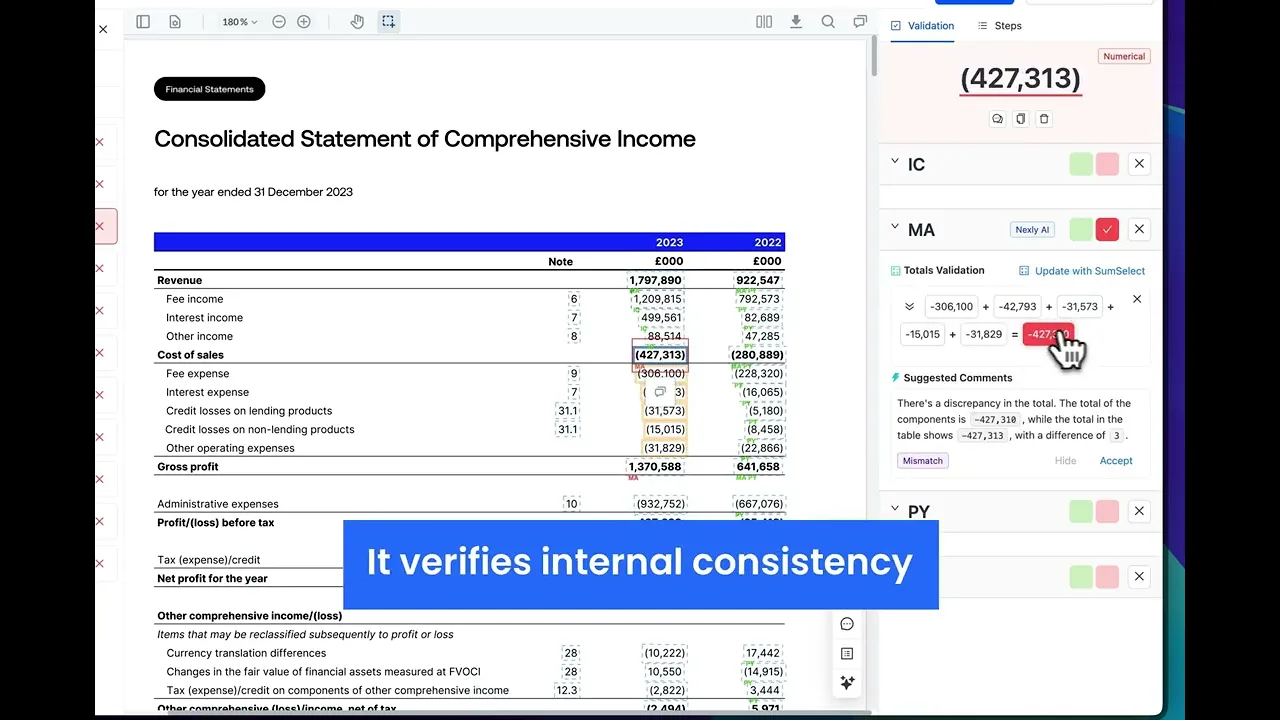

Nexly is a purpose-built platform designed to streamline the review of financial statements — helping audit teams work faster, document better, and reduce errors. It replaces outdated workflows based on static PDFs and spreadsheets with a modern, collaborative review environment.

Key Features Built for Auditors:

Automated Tick Marks

Nexly includes a full set of standard audit marks — mathematical accuracy, internal consistency, prior year consistency and consistency with external documents. All applied automatically - No need to annotate PDFs manually.Automated Notes Disclosures Review

Enterprise-Grade Security AI chat is a built-in assistant that helps audit teams review notes disclosures faster — without leaving the review environment. All interactions are processed securely within Nexly’s infrastructure — no data is shared externally.Automated Review Checklists

Built-in audit checklists adapt to the structure of the financial statements, guiding reviewers through disclosures, totals, rounding, and formatting checks. Items are automatically checked off as validations pass — significantly reducing the risk of oversight.

Why Audit Teams Choose Nexly:

40% - 60% faster review of financials statements.

Specifically designed for audit and financial reporting teams involved in the review of financial statements.

Template agnostic - works on any types of financial statements

Eliminates time wasted on cross-referencing, and manual tick marks

Enables faster, cleaner reviews - especially for professionals overseeing multiple entities

Overview of the Platform

🥈 2. Caseware Working Papers

Caseware is widely used by firms needing control over their workpapers and financial statement generation.

Key Features:

Lead sheets, adjusting journals, and trial balance tools

Templates for IFRS, GAAP, and other frameworks

Built-in documentation controls and sign-off processes

Strengths for Review:

Integrates review into working paper documentation

Supports large, complex audit files

Great for teams using structured audit methodologies

⚠️ More focused on the working paper side; doesn’t provide the same modern UI or direct interaction with financials like Nexly.

🥉 3. MindBridge – AI-Powered Risk Detection

MindBridge AI Auditor is not a review tool in the traditional sense, but it’s a powerful risk triage tool used by auditors to flag unusual transactions or financial statement risks early.

Key Features:

AI-driven risk scoring of journal entries and accounts

Detects outliers, trends, and anomalies across datasets

Dashboard visualizations for reviewer prioritization

How It Supports Review:

Helps focus statement review on high-risk areas

Complements — not replaces — manual review processes

Ideal for data-heavy audits or where fraud risk is a concern

Conclusion

In 2025, audit teams no longer need to rely on patched-together PDFs and manual spreadsheets to review financial statements. Tools like Nexly, Caseware, and MindBridge provide specialized support for a faster, smarter, and more traceable review process — helping teams focus more on judgment and less on formatting.